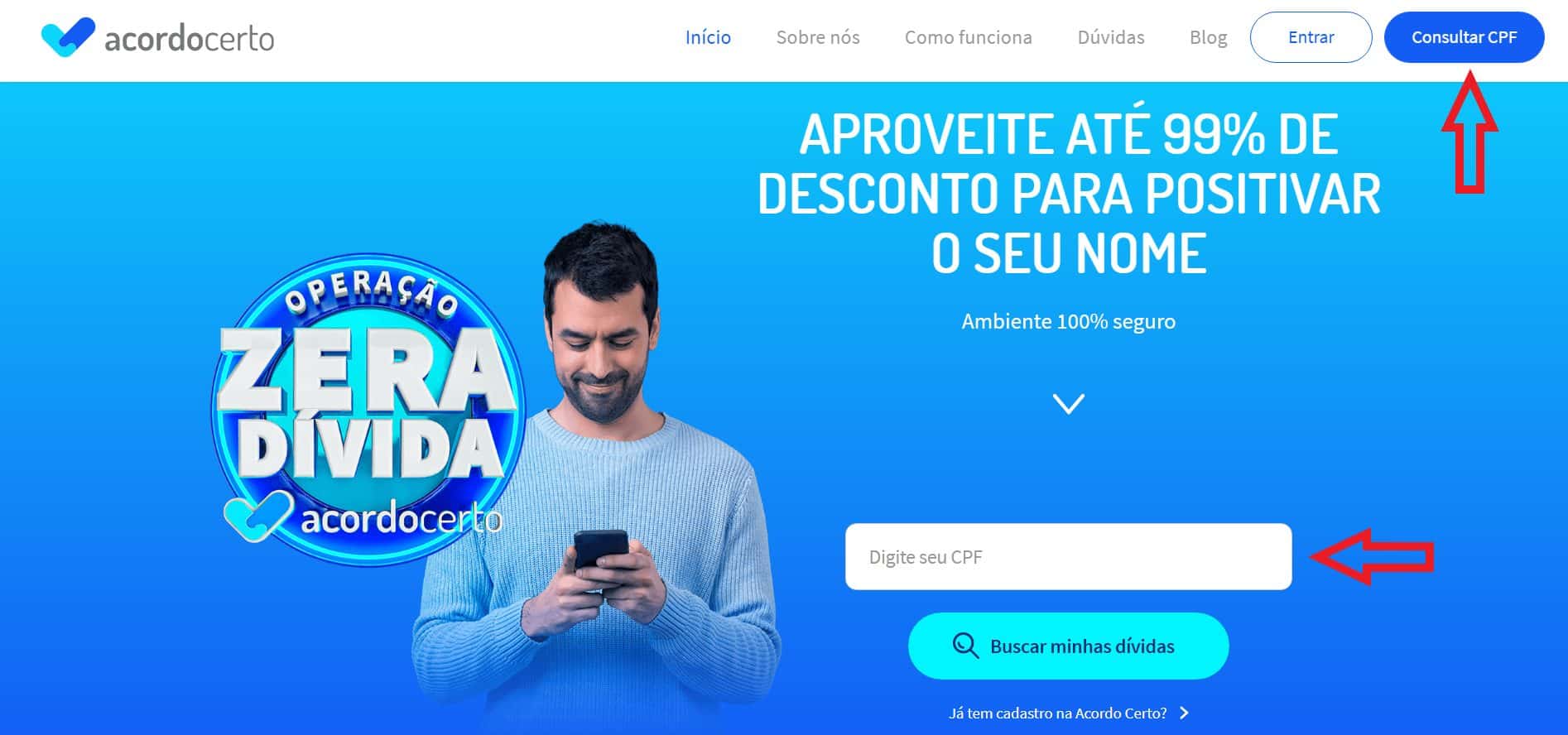

Discovering Acordocerto.com.br

My journey with Acordocerto.com.br began when I found myself overwhelmed by debt. Like many, I was searching for a solution that could help me regain control of my financial future. After some research, I stumbled upon Acordocerto, a platform that promised to simplify debt management. The user-friendly interface immediately caught my attention, making it easy to track all my debts in one place. According to a review on DiziMedia, Acordocerto is designed to help users take control of their financial future with customized debt repayment plans tailored to individual situations (DiziMedia, 2024).

Research and Decision Process

Before making any commitments, I spent a few days exploring the website. I read through various articles and reviews, including one that highlighted the platform’s security features. It reassured me that Acordocerto has been around for nearly nine years and employs advanced technologies to protect user data (Site Confiavel, 2024). This was a significant factor in my decision-making process, as I wanted to ensure my personal information would be safe.

The Purchase Experience

Once I felt confident in my choice, I signed up for Acordocerto. The registration process was straightforward, and I appreciated the clear instructions provided throughout. After entering my details, I was prompted to input my debts, which was surprisingly easy. The platform generated a customized repayment plan that felt tailored just for me. I was excited to see a clear path to financial freedom!

First Impressions

My first impression of Acordocerto was overwhelmingly positive. The dashboard was intuitive, and I could easily navigate through my debts and repayment options. I felt a sense of relief knowing that I had a plan in place. However, I did encounter a minor hiccup when I received an email about a debt I had already settled. It was a bit concerning, but I quickly learned that Acordocerto bases its notifications on data from Boa Vista SCPC and creditor partners (Reclame Aqui, 2024). This made me realize the importance of keeping my information updated on the platform.

Usage Scenarios

As I began using Acordocerto, I found it helpful in various scenarios. For instance, I could easily track my payments and see how much I had left to pay off each debt. The platform also offered tips on managing my finances better, which I found incredibly useful. I even shared some of these tips with friends who were struggling with their debts. It felt good to be part of a community that was focused on financial wellness.

Unexpected Findings

One unexpected benefit of using Acordocerto was the bonus offers that came with certain repayment plans. I was thrilled to learn that I could earn shopping vouchers as I paid off my debts. However, I did experience a delay in receiving my voucher, which was supposed to arrive within 15 days (Reclame Aqui, 2024). While it was a minor setback, it didn’t overshadow the overall positive experience I had with the platform.

Practical Insights

From my experience, I would recommend a few practical tips for anyone considering Acordocerto. First, ensure that you keep your information updated to avoid any confusion regarding your debts. Second, take advantage of the resources available on the platform, such as financial tips and community support. Lastly, be patient with the process; financial recovery takes time, but Acordocerto provides a solid foundation to build upon.

Value Assessment

In terms of value, I believe Acordocerto is worth every penny. The peace of mind I gained from having a structured repayment plan and the ability to track my progress has been invaluable. I feel empowered to take control of my finances, and I appreciate the personalized approach that Acordocerto offers. It’s not just about paying off debts; it’s about building a healthier financial future.

Future Plans with Acordocerto

Looking ahead, I plan to continue using Acordocerto as I work towards becoming debt-free. I’m excited to see how my financial situation improves over time. I also intend to explore more of the resources available on the platform, including potential partnerships with financial advisors. The journey to financial freedom is ongoing, and I’m grateful to have Acordocerto by my side.

Conclusion

In conclusion, my experience with Acordocerto.com.br has been overwhelmingly positive. From the initial research to ongoing use, I’ve felt supported and empowered in my financial journey. If you’re looking for a reliable platform to help manage your debts, I highly recommend giving Acordocerto a try. It might just be the key to unlocking your financial freedom!

References:

- DiziMedia. (2024). Acordocerto Website Review: The Key to Financial Freedom. Retrieved from DiziMedia

- Reclame Aqui. (2024). E-mails indevidos – Acordo Certo. Retrieved from Reclame Aqui

- Site Confiavel. (2024). O site acordocerto.com é confiável? Retrieved from Site Confiavel